Critical Illness Cover

Serious illness or disability usually impacts on your ability to work. Having financial worries can make a bad situation worse and impede recovery. Critical illness insurance provides you with a lump sum of money if you are diagnosed with certain illnesses or disabilities. You do not have to die. You keep the money if you make a full recovery.

The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke, loss of arms or legs, or diseases like cancer, multiple sclerosis or Parkinson’s disease. Each insurer has varying lists of what they cover and we help to ensure you have the broadest cover for the most competitive premium. See an example of the many illnesses covered here.

You can insurer against Critical Illness on its own or it can often be added to any of the types of life assurance policies we list on our Life Assurance page.

Most people have little or no provision for income and savings should they suffer a critical illness or permanent disability. Some employees of larger companies may have some benefits. Otherwise most of us have to rely on the state benefits which are very low.

More often than not, we blithely go on through life thinking that something bad as being diagnosed with a critical illness is something that won’t happen to us. Sadly, statistics tell us otherwise.

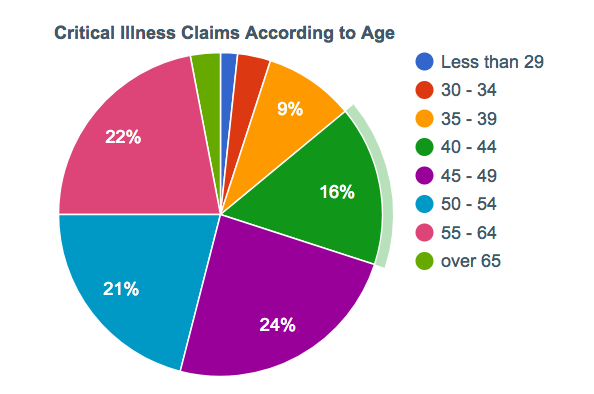

Claims reports for critical illness policies corroborate these findings. Below you can see a breakdown of critical illness claims according to age and gender, based on the Critical Illness claims report by Scottish Provident covering the first six months of 2012.

The kinds of illnesses that are covered are usually long-term and very serious conditions such as a heart attack or stroke, loss of arms or legs, or diseases like cancer, multiple sclerosis or Parkinson’s disease. Each insurer has varying lists of what they cover and we help to ensure you have the broadest cover for the most competitive premium. See an example of the many illnesses covered here.

You can insurer against Critical Illness on its own or it can often be added to any of the types of life assurance policies we list on our Life Assurance page.

Most people have little or no provision for income and savings should they suffer a critical illness or permanent disability. Some employees of larger companies may have some benefits. Otherwise most of us have to rely on the state benefits which are very low.

More often than not, we blithely go on through life thinking that something bad as being diagnosed with a critical illness is something that won’t happen to us. Sadly, statistics tell us otherwise.

- Cancer strikes a wide range of individuals, with around 293,600 new cancer diagnoses every year. This is based on information from the www.cancerresearchuk.org website.

- More than 400 people in the UK suffer from a stroke daily. Even though a considerable percent occurs at the age of 65 and above, stroke victims are getting younger through the years. There are even incidences of stroke in babies and children.

- Over 30,000 persons require heart surgery every year.

- Around 100,000 individuals in the UK are diagnosed with multiple sclerosis, a disease that strikes the young (20 to 30 years old).

Claims reports for critical illness policies corroborate these findings. Below you can see a breakdown of critical illness claims according to age and gender, based on the Critical Illness claims report by Scottish Provident covering the first six months of 2012.